The IRS published a notice of proposed rulemaking and public hearing, REG-101607-23, which proposes rules concerning monetizing energy tax credits by elective payment under the Inflation Reduction Act, on June 14, 2023. Written or electronic comments on the proposed rules are open through August 14, 2023, and a public hearing is scheduled for August 21, 2023.

Background

Under the Inflation Reduction Act, the new Internal Revenue Code (IRC) Section 6417 established a mechanism for applicable entities to treat certain energy tax credits as a payment against their federal income tax by making what the IRS terms as an elective payment—or what is referred to within the industry as direct pay or a refundable tax credit.

Direct pay makes certain clean-energy tax credits effectively refundable. An eligible entity that qualifies for a clean-energy tax credit, like a local government or Tribe, can notify the IRS that they intend to claim the credit and file an annual tax return to claim direct pay for the credit’s full value. The IRS would then pay the value of the credit to that entity.

Elective Payment Provisions for Applicable Entities

The elective payment provisions of IRC Section 6417 apply to applicable entities. Applicable entities are generally defined as:

- Tax-exempt organizations

- US state, District of Columbia, US territory, or political subdivision thereof

- Tennessee Valley Authority

- Indian Tribal governments

- Alaska Native corporations

- Rural electrical cooperatives

Other taxpayers that earn credits under IRC Sections 45Q, 45V, and 45X may also make an election to receive an elective payment pursuant to IRC Section 6417. Such taxpayers are referred to as electing taxpayers and treated as applicable entities for such purposes.

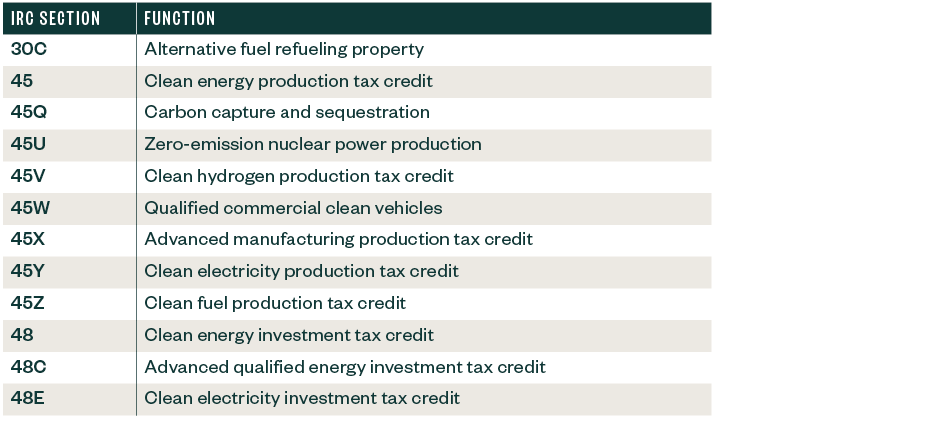

IRC Section 6417 Elective Payment Credits

Under IRC Section 6417, credits generated from the following types of projects qualify for elective payment.

Proposed Rules and Definitions

Several general rules and definitions are included in the proposed regulations that clarify the definitions of each type of applicable entity and electing taxpayers. They also provide general rules for various entities formed by an applicable entity or electing taxpayer, including disregarded taxpayers, taxable C corps, undivided ownership interests, and partnerships.

Other definitions pertaining to an applicable credit and the election are also provided. Since the payment election is made by filing an annual tax return, the proposed regulations define an annual tax return as the one normally filed by the taxpayer, and for taxpayers not normally required to file a tax return, the Form 990-T. For applicable entities, such as Tribal governments or tax-exempt entities, a Form 990-T must be filed to claim the credit.

Elective Payment Elections

An applicable entity or electing taxpayer must make an elective payment election. Note the following considerations below.

Timing of Making the Election

An applicable entity or electing taxpayer would make a claim at the time of filing their tax return for the taxable year when the credit is determined where payment wouldn’t occur until after filing the return. A prefiling registration must be completed, and a valid registration number must be noted on the filing.

Returns must be filed on time (taking into account any extensions of time). For entities not required to file, the due date is the date whenever a return would be filed, if required, with a six-month extension automatically allowed. Elections for elective payment are irrevocable once made and apply to any applicable credit for the taxable year when the election is made. The election also applies to the entire amount of the applicable credits determined with respect to each property that was properly registered.

Determination of Applicable Credit

For tax-exempt organizations and government entities making this election, the proposed rules have special provisions allowing those entities to determine the applicable credit without regard to tax-exempt use restrictions and allow those entities to treat the eligible property as used in a trade or business, allowing the full amount of the credit to be realized.

The proposed rules also make provisions for projects funded by certain grants, forgivable loans, and other tax-exempt amounts. These rules would generally allow tax-exempt amounts used to acquire an investment property in IRC Sections 30C, 45W, 48, 48C, or 48E to be included in the calculation of the credit amount.

To prevent excessive benefit, the amount of the credit plus the tax-exempt amount can’t exceed the total cost of the investment property. Several examples of the application of this proposed rule are provided.

The proposed rules also provide that any credit must be determined with respect to the applicable entity or electing taxpayer. These rules therefore prohibit an applicable entity from making an elective payment election for a transferred credit under IRC Section 6418, which allows taxpayers to make a one-time election to transfer all or a portion of eligible credits to an unrelated third party.

An IRC Section 48 energy property election can’t be made when the taxpayer makes an election under IRC Section 50(d) to pass through the credit to the lessee of the property. It also can’t be made regarding carbon capture and sequestration credits if the taxpayer makes an election under Section of 45Q(f)(3)(B) to pass the credits through to the person disposing of or using qualified carbon oxide—or using it as a tertiary injectant.

Starting in 2024, the credit amount calculated under IRC Sections 45, 45Y, 48, and 48E where elective payment election are made will be phased down if certain domestic content requirements haven’t been met.

Elective Payment Election by Electing Taxpayers

The proposed rules outline the process for taxpayers who aren’t classified as applicable entities but have received a credit under IRC Sections 45V, 45Q, and 45X to make an election and be treated as an applicable entity. Additionally, these rules clarify that the electing taxpayer may choose to revoke their election at a later time. This revocation will be permanent.

As opposed to applicable entities that can elect to receive cash payments for the full production tax credit period (10 years for IRC Section 45V, generally years prior to 2033 for IRC Section 45X and 12 years for IRC Section 45Q), electing taxpayers under IRC Sections 45V, 45Q, and 45X can only elect direct pay for the tax year the project is placed in service and the four following tax years that end before January 1, 2033.

Elective Payment by Partnership and S Corps

The proposed regulations provide that a partnership or S corp isn’t an applicable entity and can only be an electing taxpayer with respect to IRC Section 45V, 45Q, and 45X credits. This is true even if all partners in the partnership are applicable entities. Additional proposed rules that apply to partnerships and S corps are also provided.

Other Joint Ownership Structures

The proposed regulations preclude a partnership or S corp comprised of one more applicable entity to make the direct pay election, but they don’t preclude applicable entities that own property in tenancy in common and other joint ownership structures that opt out of IRC Subchapter K from electing direct pay on their interest in such property.

Taxpayers, in these instances, will need to consider the risk that IRS may treat the joint ownership arrangement as a partnership for tax purposes, which would preclude the ability of the applicable entity to elect direct pay.

Prefiling Registration Requirements

The proposed regulations provide for a mandatory prefiling registration process to help prevent fraud. The prefiling process must be satisfied before making the election.

The prefiling registration process must be completed through an IRS electronic portal, which has yet to be created. All registration requirements must be satisfied, a registration number must be received before making the election, and a registration number is required for each applicable project.

Specific information must be provided as part of the pre-filing registration process including such things as the taxpayer’s tax year, the location of each project, the placement in-service date, and other information to allow the IRS to mitigate the risk of fraud and abuse.

Other rules related to the registration number are also proposed, including rules related to a change in ownership after a number is obtained but before the project is placed in service.

Temporary regulations specific to the process were published on June 21, 2023.

Excessive Payments and Recapture

The proposed rules address excessive payments and recapture of the credits. If a payment is determined to be excessive, the amount would be the amount of the excessive payment plus 20%. The additional 20% percent wouldn’t apply if it can be demonstrated that the excessive payment resulted from reasonable cause. The proposed rules also provide an example of how the excess payment and recapture rules will be applied.

We’re Here to Help

If you have questions about this guidance or other related concerns, contact your Moss Adams professional.